Buddy Loan Personal Loan

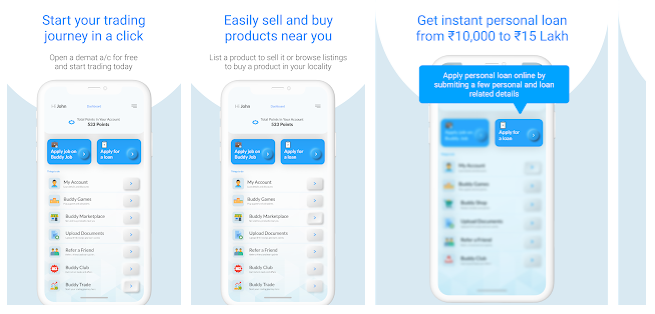

Buddy Loan online allows you to get a loan up to Rs 15 lakhs if you meet the personal loan eligibility criterion. Within 15 minutes after submitting the application, you will receive a response.

A personal loan is a standard loan that Buddy Loan aggregators may provide. You don’t have to put up any collateral to get a personal loan. Applying for one is simple (you may do it online) and you can use the funds for nearly any purpose.

Leading banks and non-banking financial companies (NBFCs) provide loans at competitive interest rates.

Personal loan highlights:

Get it immediately, with an approval rate of 80%.

Loan Approval:

Take advantage of the opportunity to network with executives from other financial institutions (banks & NBFCs). There is less space for a personal loan!

Minimal & swift documentation:

With the correct collection of documentation, loan acceptance is easier and faster. The procedure necessitates a basic document set and may differ slightly from lender to lender based on your unique loan needs.

Collateral-free loans:

Quick Personal Loans does not require any security submitted for approval.

It collects information from lenders and borrowers to improve lending transparency.

Flexible repayment options:

Personal loans are simple to get and have open-ended repayment terms. Here you may select your loan repayment type and term. (Ranges from three months to five years)

High Approval Rates & Safety:

Increase your trustworthiness by applying for an online personal loan with a high acceptance rate. There are no unlawful or unapproved practices on the API platform. It is entirely risk-free.

Get Instant Assistance:

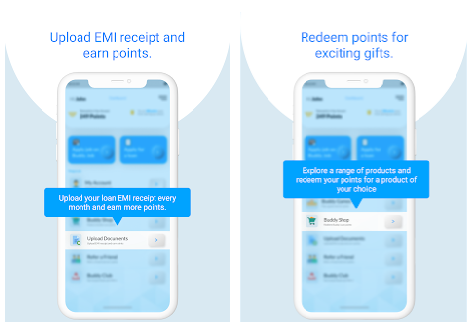

Our Buddy Loan support staff can help you with various EMIs, questions, and problems, transactions, loan terms, pre and post-payment, and acknowledgment.

Documents for personal loans and eligibility:

Proof of identity & address: You may submit your Aadhaar card and PAN card for quick personal loan approvals.

- Voter ID

- Passports

- Driving Licence

On the other hand, are acceptable.

Proof of income: A three-month wage slip from your current employer or company can be used as proof of income for a personal loan. Please keep in mind that the list of papers may differ somewhat from one lender to the next.

Eligibility Criteria:

Any salaried or self-employed person is eligible for a personal loan:

- The ideal age range is between 24 and 60.

- A basic income of 20,000 or more qualifies you for a personal loan online.

- You can acquire a personal loan for a minimum of Rs. 10,000 and a highest of Rs.1.5 Lakhs you are salaried or self-employed.

- Buddy Loan services are offered in India’s main cities and towns.

- Provide the last 3 months’ salary slips, which should support the current income criteria.

- Have a CIBIL score of between (700 – and 900).

- If you have a good credit history, you can get a loan approved faster and at a cheaper interest rate.

Calculate your EMI for a personal loan.

Now is the time to make a proactive decision to satisfy your financial needs. The better technique to choose your lender and the necessary loan amount for your loan application:

Personal loan amount based on your salary:

Your monthly payout – EMI = [P x R x (1+R) ^N]/ [(1+R) ^N-1]

Representative Example:

For Rs.1,00,000/- borrowed for 1 year, with interest rate @13% per annum*, a user would pay:

- Processing fee (@ 2%) = Rs.2,000/- + GST = Rs.2,360/-

- (Line setup fee of Rs.499/- +GST = Rs.588/- to be paid before starting the credit line

- Interest = Rs.7,181/-

- EMI = Rs.8,932/-

- Total amount to be repaid after a year = Rs.1,10,129/-

- *Your interest rate is determined by your risk profile.

- The maximum Annual Interest Rate (APR) can go up to 36%

- (However, only a small percentage of our clients receive an interest rate greater than 30% every year.)

FAQs

Q-1 Q-1 which situation can we apply for a personal loan?

- Any necessity or price may be met with a personal loan. It can assist you in managing a range of financial issues, including:

- Travel \wedding

- Employed by a multinational corporation, a public or private enterprise, or self-employed.

- Emergencies in medicine

- Renovating your home

- With the right education comes many more emergencies.

Q-2 How can I Calculate EMI for a Personal Loan?

- The application process for a personal loan with Buddy loan is straightforward.

Q-3 Does Buddy loan have any pre-payment charges to disburse a personal loan?

- No, there are no pre-payment penalties with a Buddy loan.

Q-4 What is the minimum loan salary required to avail of a personal loan?

- Buddy Loan Aggregator provides the simplest personal loan application process.

Q-5 Why should you choose a personal loan by buddy loan?

- Instant Loan

- There is very little documentation.

- Term lengths that are flexible

- There are no hidden fees.

- Fill out the online application form to get a personal loan.

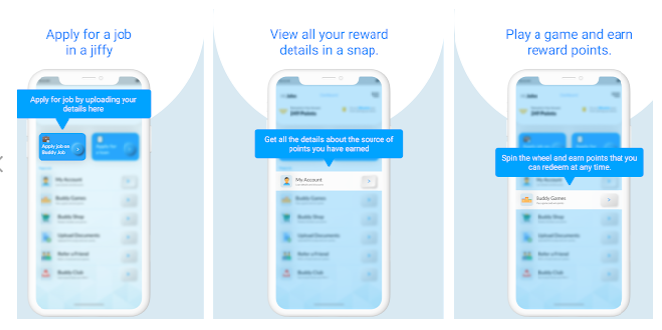

Q-6 How to apply for a personal loan with Buddy loan?

- A personal loan may be obtained quickly with no collateral, minimum documentation, and a variety of financing alternatives. The procedure is simple, quick, and directed to ensure a smooth lending transaction.

Improve your loan’s reputation by taking out a personal loan with no defaults.

1: Go to https://www.buddyloan.com/ and download the Buddy Loan app from the Google Play Store. To verify and compare loan features online, go to our website.

2: Fill in all of your personal information as well as the projected loan amount.

3: Upload all of your supporting documents to the internet.

4: From the dashboard panel, select a lender.

5: Submit an application for a loan.

Disclaimer: We only provide information regarding applications, loans, NBFCs, jobs, and new programs after thoroughly reviewing their official websites. Buddy Loan App will provide you with the loan.